Financial Planning

A Progressive financial planning the process of meeting your life goals through proper management of your fiancés. You need to understand that each of life decision you make will affect different areas of finances.

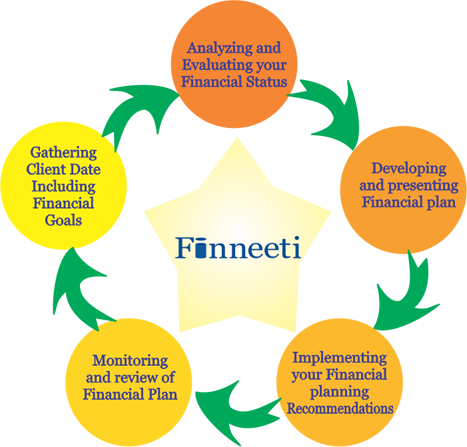

We do this by the below given process

Once the plan is in place, it needs to be monitored, reviewed, and updated to meet dynamic circumstances.

Financial Planning simply put is planning for the future. It is preparing oneself and one’s family for future events like child education, retirement, child marriage, wealth creation, life security and so on. It is planning for uncertain events with some degree of certainty by taking factors like interest rates, inflation, taxation, cash flows, current expenses and lifestyle into consideration. After which, a Financial Planner, recommends the best possible allocation of existing and future resources to help meet future goals.

Financial Planning is a lengthy and ongoing process.

It takes into consideration, investment management, risk management, retirement planning, tax planning, cash flows present and future and estate planning, and since these factors are subject to change, with changing policies, environment, the financial plan, needs to be reviewed on a regular basis. Have you planned for- Retirement after considering inflation at the time of investing and at the time of receiving regular inflows and taxation at the time of both saving and receiving regular income.

- Increased medical expenses at retirement.

- Your child’s education, after consideration of inflation at today’s value terms.

- Your child’s marriage expenses.

- The dream home you wanted to purchase five years from today.

- The car you wanted to buy.

- The wealth you wanted to create for closing liabilities and for a rainy day.

- The estate you wanted to leave behind for your wife and kids.